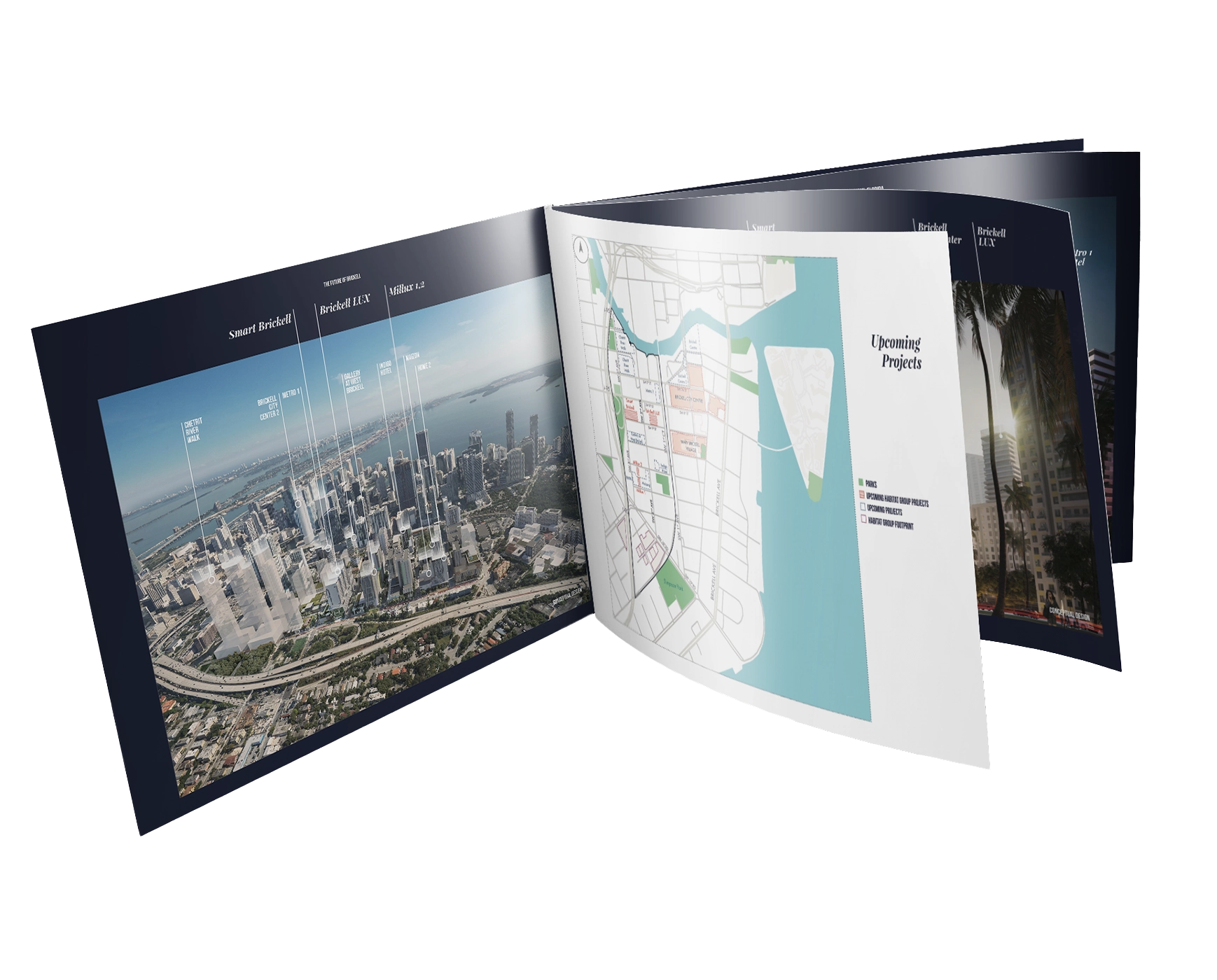

We are a passionate team devoted to the development of real estate in Miami. Habitat Group has been developing and operating residential, hotel and commercial units in the Brickell neighborhood for over 15 years.

CURRENT

PROJECTS

COMPLETED

PROJECTS

HOTELS

HAPPY CLIENTS